NOTA CIENTIFICA

Determination of the price in the fresh fruit market: case of pears

Determinación del precio en el mercado de frutas frescas: caso de peras

Miguel Ángel Giacinti Battistuzzi 1*, José Ramos Pires Manso 2, Jaime de Pablo Valenciano 3

1 Gabinete MAG: acrónimo de Miguel Angel Giacinti. Argentina. Centenario. Q8309. Argentina. * miguel.giacinti@gabinetemag.com

2 University of Beira Interior (Portugal). University Beira Interior (UBI). Est. Sineiro s/n 6200209 Covilha. Portugal. NECE: Research Center in Business Sciences, is a Department of Management and Economics the University of Beira Interior (UBI) pmanso@ubi.pt

3 University of Almeria. Cañada de San Urbano. 04120 Almería. Spain. jdepablo@ual.es

Originales: Recepción: 10/11/2018 - Aceptación: 19/06/2019

ABSTRACT

This document aims to evaluate the determinants of the price of pears in the international fresh fruit market, from an innovative vision in a complex world. The panel data methodology was applied. The variables considered were the different prices (CIF/kg) of pear, apple and stone fruits, their per capita consumptions, real per capita income, consumer price indexes and real exchange rates. Pear consumption responds especially to apple consumption, but also to prices of apples and peaches, real per capita income, consumer price indexes and countries’ exchange rates. This might imply improving commercial efficiency in international trade, effective budgets in price formation, and giving new impetus to studies on the price of fruits and foods with a new vision.

Keywords: Pears; Apples; Peaches; CIF import price

RESUMEN

Este documento tiene como objetivo evaluar los determinantes del precio de la pera en el mercado internacional, en la demanda en fresco; desde una visión innovadora en un mundo global y complejo. Se aplica la metodología de panel de datos. Las variables consideradas son los diferentes precios de importación (CIF/kg) de pera, manzana y duraznos; sus consumos per cápita, ingresos reales per cápita, índices de precios al consumidor y tasas de cambio de los países. Esto implica mejorar la eficiencia comercial en el comercio internacional, presupuestos efectivos en la formación de precios, además de dar un nuevo impulso a los estudios sobre el precio de las frutas y los alimentos con una nueva visión.

Keywords: Peras; Manzanas; Duraznos; Precio importación CIF

INTRODUCTION

The historical paradigm in the fruit market is that the main determinant of the sale price is the volume of supply of the same product. It responds to a simple model, with direct relationship, offer and price. Numerous studies provide information on price elasticity in fruits (2, 7, 12, 18, 19, 20, 30).

Also many studies indicate that demographic factors and economic growth also influence the consumption of fruits (1, 3, 5, 8, 11, 15).

Literature on the topic shows publications on the demand of apples and pears, at the level of individual countries and not globally (Vosloo and Groenewald 1969, Tunstal and Quilkey 1990 and Kavitha et al. 2016). Vosloo and Groenewald (1969) focused on the apple demand analysis in South Africa, where the availability of pears and oranges is considered as a factor explaining the price of apples.

On the other hand, Tunstal and Quilkey (1990), used the disappearance of storage pears to explain the average monthly price of apples in the Victorian wholesale market. Other investigations explain the link between prices of pear and apple, as is the case of (Wani et al. 2015). A significant change in the fresh fruit market can be driven by the emergence of new consumption preferences (4, 9, 17, 26, 27, 29).

This contrasts with the recent opinion of some commercial operators of the international fruit business, at least partially. They point out that the definition of price for pears is not based on their volume of supply, but on the price of late peaches at the beginning of the pears harvest, and then on the supply of apples for the rest of the season.

The discussion with people linked to the international trade of fruits (mainly pears and apples), highlight the importance of evaluating this new vision in the formation of the sale price in a globalized environment, thinking that perhaps changes in trade are evident and that currently they are not considered in a commercial planning. For an improvement in the efficiency of the value chain. Kevin Moffitt, Pear Bureau Northwest President (22), comments on a favourable opinion to relaunch the research on price behaviour.

This situation encouraged the project of a structural and comprehensive analysis on the determination of the main factors in the price of pears worldwide, combining the offer of both hemispheres -north and south. The novelty is the analysis based on world trade, in relation to other fruits -analysing peaches and apples- and economic variables of the main importing countries - per capita real income, price indexes and actual annual country exchange rates.

MATERIALS AND METHODS

Our analysis used yearly data from the period 1990-2015. The sample panel was composed of 18 countries, the main world importers in the international demand for fresh pears: Brazil, Canada, Denmark, France, Germany, India, Indonesia, Italy, Malaysia, Mexico, Portugal, Russian Federation, Saudi Arabia, Singapore, Spain, Sweden, UK and USA. China and Argentina are the main exporters, but have low relevance as importers worldwide. This research focused on demand factors from the main importing countries.

The variables considered for the analysis were pear prices (cif/kg), per capita consumptions of pears, apples and stone fruits, per capita real income, consumption price indexes and real annual country exchange rates (local currency per USD). The data source was the World Development Indicators (28). As usual, all the values were converted in their natural logarithms, to reduce variability, and were codified to facilitate data handling and computer processing. Logistics of perishable foods in the domestic market affects prices and consumer availability (23), for this reason choosing of the import price (cif: Cost Insurance and Freight) allowed avoiding asymmetries of wholesale and retail prices.

As stated by Greene (2012), Maddala, G. S. (2001), Hsiao et al. (1999), in statistics and econometrics, panel data (or longitudinal data) refers to multidimensional data frequently involving measurements over time, containing observations of multiple phenomena obtained over multiple time periods for the same firms, regions, countries or individuals. Time series and cross-sectional data are special cases of panel data that are in one dimension with only one panel member or individual for the former, one time point for the latter. Panel data analysis is a statistical method, generally used in social sciences, epidemiology, energy and econometrics, which deals with two and "n"-dimensional (in and by the cross sectional/times series time) panel data. The data are usually collected over time and over the same "individuals". Then a regression is run over these two dimensions. Multidimensional analysis is an econometric method in which data are collected over more than two dimensions (typically, time, individuals, and some third dimensions). A simplified common panel data regression model looks like

yit=a+bxit+εit

where:

y = the dependent variable

x = the independent variable

a and b = the coefficients

i and t = indices for individuals and time.

The error εit is subject for hypothesis. Assumptions about this error term determine whether we speak of fixed effects or random effects. In a fixed effects' model, εit, is assumed to vary non-stochastically over i or t making the fixed effects model similar to a dummy variable model in one dimension. In a random effects' model, εit is assumed to vary stochastically over i or t requiring special treatment of the error variance matrix.

Panel data analysis has three more or less independent approaches: independently pooled panels, used as benchmark, random effects models and fixed effects models (or first differenced models). The selection between these methods depends upon the objective of the analysis, and the problems concerning the exogeneity of the explanatory variables.

The main assumption of the independently pooled panels is that there are no unique attributes of individuals within the measurement set, and no universal effects across time. On his turn, the key assumption of the fixed effect models (FEM), also known as Least Squares Dummy Variable Model (LSDVM), is that there are unique attributes of individuals that are not the results of random variation and that do not vary across time. To draw inferences only about the examined individuals, is adequate. The main statement of the random effect models (REM) is that there are unique, time constant attributes of individuals that are the results of random variation and do not correlate with the individual regressors. This model is adequate if we want to draw inferences about the whole population and not only the examined sample. The Durbin- Wu-Hausman or simply the Hausman specification test, is a statistical hypothesis test in econometrics named after James Durbin, De-Min Wu, and Jerry A. Hausman that evaluates the consistency of an estimator when compared to a less efficient alter- native estimator which is already known to be consistent. It helps to evaluate if a statistical model corresponds to the data.

Let y=bX+e be a linear model

where:

y = the dependent variable

X = a vector of regressors

b = a vector of coefficients

e = the error term.

We have two estimators for b, b0 and b1. Under the null hypothesis, both estimators are consistent, but b1 is efficient (has the smallest asymptotic variance), at least in the class of estimators containing b0. Under the alternative hypothesis, b0 is consistent, whereas b1 is not. The Wu-Hausman statistic is defined as:

(1)

H = (b1-b0)1(Var(b0)-Var(b1))† (b1-b0),

where:

† = denotes the Moore-Penrose pseudoinverse.

Under the null hypothesis, this statistic has asymptotically the chi-squared distribution with the number of degrees of freedom equal to the rank of matrix Var(b0) - Var(b1). If we reject the null hypothesis, it means that b1 is inconsistent. This test can be used to check for the endogeneity of a variable (by comparing instrumental variable (IV) estimates to ordinary least squares (OLS) estimates). It can also be used to check the validity of extra instruments by comparing IV estimates using a full set of instruments Z to IV estimates that use a proper subset of Z. Note that for the test to work in the latter case, we must be certain of the validity of the subset of Z and that subset must have enough instruments to identify the parameters of the equation. Hausman, also showed that the covariance between an efficient estimator and the difference of an efficient and inefficient estimator is zero.

The advantages and disadvantages of panel data models can also be seen in the referred literature (6, 10, 13, 16).

RESULTS

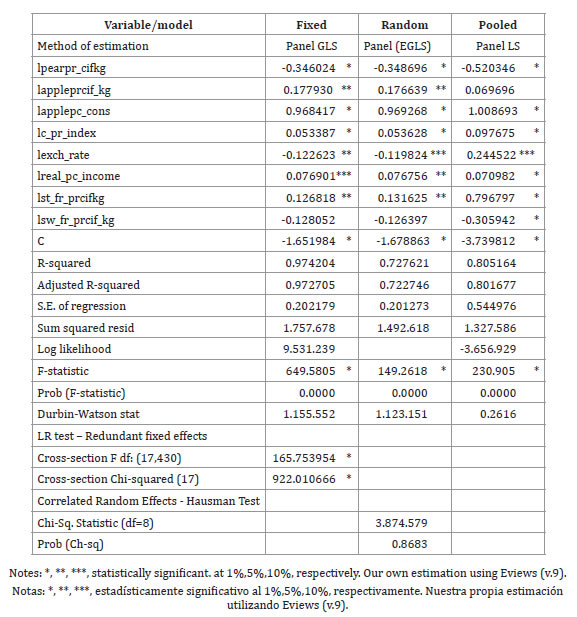

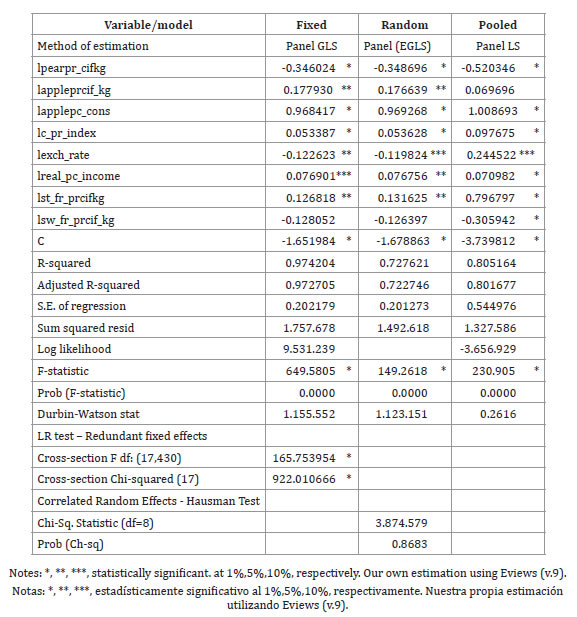

The explanatory power of the estimated models, were highly and statistically significant. The Hausman test showed that, among the three cited models (table 1), the random effects model (EGLS Panel), was the best for studying this complicated international food market.

Table 1. Results of the three panel data model estimates.

Tabla 1. Resultados de las estimaciones de los tres modelos de panel de datos.

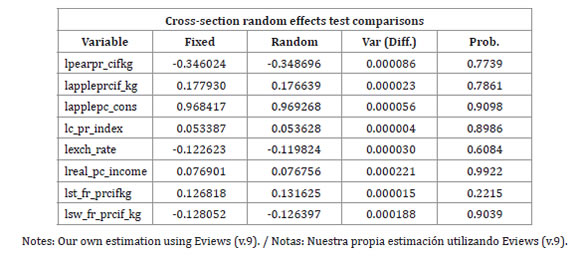

However, the type of effects and the statistical significance of the coefficients were concordant in the three considered models. Using the results of the estimation based on the EGLS Panel estimation method, the Hausman test proved to be the best solution in the current situation (table 2, page 230).

Table 2. Hausman test comparisons (Fixed/Random).

Tabla 2. Comparación del test de Hausman (Fijo/Aleatorio).

All the coefficients or elasticities were statistically significant, four of them at the 1% level of significance, three at 5% and one at 10%. The only coefficient or elasticity that was not significant in statistical terms at the usual levels of significance is the price (cif) of stone fruits. Possibly explained, by the influence of late variety stone fruit that impacts the beginning of the pear harvest.

The overall regression (REM) was highly significant in statistical terms (Prob (F-stat) = 0.0000). The explicative power of this model (random effects model) was 0.72 and highly significant since F-stat=149.26 and Prof (F-stat=0.0000), while in the fixed effects the R-squared is very high (97.4%), and significant (F-Stst=649.58 and Prob (F-statistic) = 0.0000. We had to be cautious about these interpretations since some possibilities of having autoregressive errors taking in account the Durbin-Watson test (Durbin- Watson, d=1.156) were present. However, we did not suspect of heterocedasticity, nor of multicolinearity among the explicative factors considered using the classic test and the correlation's test.

We did not reject the endogeneity problem since we could not reject the null hypothesis (chi-squared stat=3.87, d.f. = 8, Prob (ch-sq) = 0.87) stating that the regressors were correlated with the model errors. As referred before, the Hausman test (table 2) suggested that the best model to identify and measure the explicative factors of the demand for pears was the random effects' one. Furthermore, the Likelihood Ratio (LR) test applied to the results of the fixed effects model suggested the rejection of the redundancy of the different sections.

With these results, we got empirical evidence that pear consumption is positively associated with the prices of apples (elasticity=0.178**), with per capita apple’s consumption (elasticity=0.968*), with the average index price (elasticity=0.053*), with real per capita income (elasticity=0.077***) and with the price of stone fruits (elasticity=0.127**).

On the other hand, pear consumption was negatively correlated both with pear price (cif) (elasticity = -0.346 *) and exchange rate (elasticity = -0.123 **). The demand elasticities of the factors for pears could be classified as rigid since all of them have absolute values less than 1, suggesting that there was no much scope to intervene in the market. Besides pear consumption, price-response to its own price and to the price of fruits like apple and stone fruits should be expected. Pear consumption is especially and moderately responsive to apple consumption (0.968) (the highest elasticity consumption).

The explanatory power of the estimated models, were highly and statistically significant. The Hausman test showed that, among the three cited models, the random effects model, was the most indicated to study this complicated international food market. However, the type of effects and the statistical significance of the coefficients were concordant in the three considered models.

Tunstal and Quilkey (1990) reached the same conclusion established in this work when studying the relationship between pears and apples.

CONCLUSIONS

The analysis adds empirical evidence to the fact that the consumption of pear responds especially to the consumption and the price of apple. Other determinants of the demand for pears are the set of selling prices for apples and stone fruits (for example, nectarines and peaches at the beginning of the pear harvest), and the real per capita income. The synergy between pears and apples in the fresh produce market is an important conclusion and a feature that confirms that pear sellers generally also sell apples and vice versa.

The result of the research is relevant to the pear exporting producers and companies (Argentina, the world's leading exporter), as well as to academics linked to the international trade of fresh fruits; providing knowledge that may increase efficiency in the value chain.

Surely, this research will change the paradigm in the fresh pear business in general (confirming the opinion of those linked to foreign trade. It will also boost research on the price elasticity with a new global approach and complex vision in the fruit and other foods market.

1. Abler, D. 2010. Demand growth in developing countries. OECD Food, Agriculture and Fisheries Papers. No. 29. OECD Publishing, Paris. https://doi.org/10.1787/5km91p2xcsd4-en.

2. Arnade, C. Pick, D. 1998. Seasonality and unit roots: the demand for fruits. Agricultural Economics. 18(1): 53-62.

3. Burell, A.; Henningsen, A. 2001. An empirical investigation of the demand for bananas in Germany. Agrarwirtschaft. 50(4): 242-248.

4. Carrillo-Rodriguez, L.; Gallardo, K.; Yue, C.; McCracken, V.; Luby, J.; Mcferson, J. R. 2013. Consumer preferences for apple quality traits. In 2013 Annual Meeting.

5. Cramer, J. S. 1973. Interaction of income and price in consumer demand. International Economic Review. p. 351-363.

6. Dawe, D. C.; Morales-Opazo, C.; Balie, J.; Pierre, G. 2015. How much have domestic food prices increased in the new era of higher food prices. Global Food Sec. 5: 1-10.

7. Durham, C.; Eales, J. 2010. Demand elasticities for fresh fruit at the retail level. Applied Economics. 42(11): 1345-1354.

8. Epstein, L. L.; Handley, E.; Dearing, K.; Cho, D.; Roemmich, J.; Paluch, R.; Raja, S.; Pak, Y.; Spring, B. 2006. Purchases of food in youth: influence of price and income. Psychological Science. vol. 17(1): 82-89.

9. Gallardo, R.; Hong, Y.; Jaimes, M.; Flores, J. 2018. Investigating consumer food choice behavior: An application combining sensory evaluation and experimental auctions. Ciencia e Investigacion Agraria. 45(1): 1-10.

10. Greene, W. 2012. Econometric Analysis (7th ed.). Pearson. p. 234-237.

11. Gwynne, Robert N. 1999. Globalisation, commodity chains and fruit exporting regions in Chile. Tijdschrift voor economische en sociale geografie. 90(2): 211-225.

12. Harker, F. R.; Gunson, F. A.; Jaeger, S. R. 2003. The case for fruit quality: an interpretive review of consumer attitudes, and preferences for apples. Postharvest Biol Technol. 28: 333-347.

13. Hsiao, C.; Lahiri, K.; Lee, L.; Pesaran, M. H. 1999. Analysis of panels and limited dependent variable models. Cambridge: Cambridge University Press.

14. Kavitha, V.; Umanath, M.; Paramasivam, R.; Chandran, K. 2016. Determinants of consumption probability and demand for fruits in India. Agricultural Economics Research Review. 29: 161-170.

15. Kyriakidi, A.; Drichoutis, A. 2007. Determinants of demand for fruit variety. 3rd HO PhD Symposium on Contemporary Greece. London. UK.

16. Maddala, G. S. 2001. Introduction to Econometrics (3rd. ed.). New York: Wiley.

17. Millichamp, A.; Gallegos, D. 2013. Comparing the availability, price, variety and quality of fruits and vegetables across retail outlets and by area-level socio-economic position. Public health nutrition. 16(1): 171-178.

18. Prais, S. J. 1962. Econometric research in international trade: a review. Kyklos. 15(3): 560-574.

19. Price, D. W.; Mittelhammer, Ronald, C. A. 1979. Matrix of Demand Elas: ticities for Fresh Fruits. Western Journal of Agricultural Economics. p. 69-86.

20. Tozer, P.; Marsh, T.; Jíang, M. 2014. Perennial Supply-Substitution in Bearing Acreage decisions. En 2014 Annual Meeting. Agricultural and Applied Economics Association, Minneapolis, Minnesota.

21. Tunstall, A. W.; Quilkey, J. J. 1990. Storage and pricing of apples: Some empirical evidence on the structure of the Victorian wholesale market. Australian Journal of Agricultural Economics. 34(3): 280-291.

22. US PEARS 2017. The Pear Bureau Northwest of United States Available in: (https://usapears.org/)

23. Valdes Salazar, R. 2018. Measuring market integration and pricing efficiency along regional maize-tortilla chains of Mexico. Revista de la Facultad de Ciencias Agrarias. Universidad Nacional de Cuyo. Mendoza. Argentina. 50(2): 279-292.

24. Vosloo, J. J.; Groenewald, J. A. 1969. The demand for apples in South Africa-a statistical analysis. Agricultural Economics Research. Policy and Practice in Southern Africa. 8(4): 21-25

25. Wani, M. H.; Sehar, H.; Paul, R. K.; Kuruvila, A.; Hussain, I. 2015. Supply response of horticultural crops: the case of apple and pear in Jammu & Kashmir. Agricultural Economics Research Review. 28(1): 83-89. DOI: 10.5958/0974-0279.2015.00006.3

26. Watson, J.; Wysocki, A.; Gunderson, M.; Brecht, T.; Sims, C. 2012. Fresh hammock-packed bartlett pears: implications for marketing based on consumers' willingness to pay for sensory attributes and return on invesment potential. Annual Meeting. Agricultural and Applied Economics Association. Seattle. Washington.

27. Wismer, W. V. 2014. Consumer eating habits and perceptions of fresh produce quality. Postharvest Handling. 31-52.

28. WORLD BANK 2016. World Economic Indicators. World bank databases.

29. Yaseen, A.; Mehdi, M.; Somogyi, S.; Ahmad, B. 2016. Consumer preferences to pay a price premium for quality attributes in Pakistani grown mangoes. Pakistan Journal of Commerce and Social Sciences. 10(3): 615-637.

30. You, Z.; Epperson, J.; Huang, C. 1996. A composite system demand analysis for fresh fruits and vegetables in the United States. Journal of Food Distribution Research. 27: 11-22.