ORIGINAL ARTICLE

Olive oil and the millennial generation in Chile. What do these consumers consider when buying this product?

Aceite de oliva y la generación del milenio en Chile. ¿Qué consideran estos consumidores cuando compran este producto?

Marcos Mora 1*, Berta Schnettler 2, Germán Lobos 3, Cristian Geldes 4, Sofía Boza 1, María del Carmen Lapo 5, Ruth Paz 6

1 Universidad de Chile. Santa Rosa 11.315. Faculty of Agricultural Sciences. Department of Management and Rural Innovation. La Pintana Santiago. Chile. C. P. 8820808. * mmorag@uchile.cl

2 Universidad de la Frontera. Faculty of Agricultural and Forestry Sciences. Avda. Francisco Salazar 01145. Temuco. Chile. C. P. 4780000.

3 Universidad de Talca. Faculty of Business and Economics. C. P. 3465548 Talca. Chile. Visiting Professor. Universidad Católica de Santiago de Guayaquil (UCSG) in Ecuador.

4 Universidad Alberto Hurtado. Faculty of Economics and Business. Department of Management and Business. Erasmo Escala 1835. office 204. Santiago. Chile Postal Code 8340539.

5 Universidad Católica de Santiago de Guayaquil. Associate Professor. Ecuador. Address: Av Carlos Julio Arosemena Km 1.5. C. P. 090615.

6 Universidad de Chile. Program of Doctorate in Agricultural Sciences. Santa Rosa 11.315. La Pintana Santiago. Chile. C. P. 8820808.

Originales: Recepción: 03/05/2019 - Aceptación: 25/10/2019

ABSTRACT

This study aimed to identify the attributes influencing the purchase decision process of the olive oil consumer belonging to "Millennials" in the Metropolitan Region, Chile. The method includes data collection from 408 people and a combination of factorial and cluster analysis. The results identified two segments in the millennial consumers. In the purchasing, one of the consumer groups, with 150 people, attached importance to product information and origin, as well as oil category, colour, and acidity. The other group with 258 people rejected a large part of the attributes, except for that related to electronic commerce. These results suggest that the search for attractive attributes in a broad sense is relevant and should be considered in the development of commercial strategies for the segment that positively values all attributes. However, for that segment rejecting intrinsic attributes, it would be advisable to deepen on aspects related to technology and social network.

Keywords: Oil olive; Consumer; Segmentation; Millennials; Chile

RESUMEN

Este estudio tiene como objetivo identificar los atributos que influyen en el proceso de decisión de compra del consumidor de aceite de oliva perteneciente a "Millennials" en la Región Metropolitana, Chile. El método incluye la recolección de datos de 408 personas y una combinación de análisis factorial y de conglomerados. Los resultados identifican dos segmentos en los consumidores milenarios. En la compra, uno de los grupos de consumidores, con 150 personas, da importancia a la información y al origen del producto, así como a la categoría de aceite, al color y a la acidez. El otro grupo con 258 personas rechaza gran parte de los atributos, excepto el relacionado con el comercio electrónico. Estos resultados sugieren que la búsqueda de atributos atractivos en sentido amplio es relevante y debe ser considerada en el desarrollo de estrategias comerciales para el segmento que valoren positivamente todos los atributos. Sin embargo, para ese segmento que rechaza los atributos intrínsecos, sería aconsejable profundizar en aspectos relacionados con la tecnología y las redes sociales.

Palabras clave: Aceite de oliva; Consumidor; Segmentación; Millenials; Chile

INTRODUCTION

The "Millennials" or "Generation Y" is an increasing market that prefers healthy products, such as olive oil. In Chile, this generation is about 5,5 million people (31% of the population). Reasons to understand this segment of the market in order to develop commercial strategies for companies, as well as designing public policies related to the promotion of healthy food like olive oil are strategic. Thus, the objective of this study is to know what the Chilean Millennial consumers consider when buying olive oil.

Meanwhile, since the year 2000, the olive oil industry has been extraordinarily developed. Olive oil is a recognized product for its health benefits (29), in line with the preferences of "generation Y", including health fact like fat content, and animal or plant origin (26). Moreover, consumer preferences vary among countries. For instance, in Southern Europe, olive oil is widely known and mainly consumed for its health benefits (48, 50, 59). However, there is a relevant gap for market development in emerging countries like Chile, where the use of this product has been increasing progressively among the population, showing special concern about healthy diets (7). Between 2005 and 2015, olive oil consumption in Chile almost doubled, going from 204 grams to over 390 grams (8). Meanwhile production has been significantly growing from 2005 to 2014, going from 2,000 t to 18,500 t (9). Specifically, in the case of the Chilean market, preferences are driven to extra virgin oil in glass bottles, in less-than-one litre formats and fruity flavoured. About the usage given to the oil in this market, it is mostly chosen for salads, whereas the European market uses it in all types of consumption, including cooking and frying. In addition, in Chile, olive oil has a known value in relation to health benefits (48, 50, 59). There is a relevant gap of market development in emerging countries like Chile, where the use of this product has been increasing progressively among the population, especially showing more concern about healthy diets (7, 21). Between 2005 and 2015, olive oil consumption in Chile almost doubled, going from 204 grams to over 390 grams (8). While production has been significantly growing from 2005 to 2014, going from 2,000 t to 18,500 t (9). Specifically, in the case of the Chilean market, preferences are driven to extra virgin oil in glass bottles, in less-than-one litre formats and fruity flavoured. About the usage given to the oil in this market, it is mostly chosen for salads, whereas the European one uses it with all types of consumption, including cooking and frying. In Chile, olive oil shows a higher income elasticity of demand than other oils (54). Therefore, the increase in demand in this country is somewhat conditioned by people’s purchasing power. On the other hand, the demand between 2006 and 2015 has shown a trend toward decreasing imported oil consumption due to a preference for national oils (9). In Chile, 80% is locally produced, whereas 20% is imported mainly from Argentina and Spain (8).

Given the aforementioned, and since by the year 2020, Millenial will constitute a worldwide market of 200 billion dollars annually it might be relevant to learn these specific consumers (61). In that sense, some researchers consider that "generation Y" is made up of people born between 1980 and 2000 (17). One generation corresponds to a cohort of people born over 20 years, sharing beliefs, attitudes and behaviours, while feeling members of the same generation, and having experienced significant historical events and trends at the same stage of life (63). According to Taylor and Cosenza (2002), most of the millennial generation is already inserted into the workforce and has extensive technological knowledge, which makes them important consumers (62). This point suggests that the "online" market may be thriving in addressing these types of customers (9).

Moreover, to understand the millennials it is necessary to keep in mind that they have dealt with big, exciting, and dynamic changes during their childhood and youth, such as virtual business opportunities and gender equality. They also consider the opinion of non-governmental organizations and groups for their decision-making process (53). In the Chilean case, the Millennial generation is characterized by their appreciation of economic aspects as well as social aspects like social network and pleasant workplaces, among others. Pincheira and Arenas (2016), report that their main characteristics are dependent on social network and access to technology (51).

The industry of olive oil in Chile

The Chilean olive oil industry has had sustained growth, from the nineties to the present. Domestic and export demand-supply have increased (8). This is partly explained because olive oil is considered an essential food in the Mediterranean Diet, and it has been associated with a significant contribution to people's longevity as well as the prevention of heart diseases, diabetes, obesity, and cancer (44, 48).

Attributes olive oil considered by consumers

The description of attributes considered in the consumption of olive oil is based on the "multi-attribute" classification, which conceives the quality of a product as a set of attributes that are separated into "intrinsic" and "extrinsic" signals (25, 35, 41, 49, 65, 66). Intrinsic signals allow the objective measurement of quality. These qualities impregnate the product with its functionality and are related to its physical appearance, are specific to each product, disappear when they are consumed (49), and cannot be altered without changing the nature of the product itself (3). On the other hand, extrinsic attributes have a more or less close relationship with the product, but remain, by definition, outside their essence (49). Cheng et al. (2008) consider, totally or partially, as extrinsic attributes the price, the brand, and the advertising (28). Other extrinsic attributes are the date of manufacture and consumption, place of origin of the product and production techniques (6, 28). Specifically, in the case of olive oil, Del Giudice et al. (2012), refer to both types of attributes. The extrinsic attributes are, for example, certification of origin of olive oil, safety of the associated product to the production method (organic system and traceability), commercial brand and price (16). On the other hand, intrinsic attributes are mainly the flavour and colour. In Chile, Romo et al. (2015) suggested a positive relationship between acidity (intrinsic attribute) and the oil quality as well as between the latter and the origin. They also raised an inverse relationship between payment arrangement and olive oil in plastic bottle (55). Regarding the presented background, this investigation had the following hypothesis (H1): It is possible to identify two or more segments of Chilean consumers in the millennial generation who consider different attributes in the purchase of olive oil

MATERIALS AND METHODS

Data description

The study site was the "Commune of La Florida" (local and administrative area) in the Metropolitan Region of Chile. It has a total population of 397,456 habitants, with 198,706 males and 198,750 females (30). This area is constituted of four main sectors: "San José de la Estrella", "Santa Raquel", "La Florida", and "Lo Cañas". These sectors show different socioeconomic groups allowing to characterize this area as multiclass commune with a heterogeneous population (52).

The sample was selected by "convenience", and it drives to a population segment including 468 Millennials resident in the "Commune of La Florida". From this sample, 408 (87.2%) people declared usual or sporadic consumption of olive oil. The remaining 60 people (12.8%) do not consume olive oil. Consequently, the valid sample number of consumers for the analysis was 408 persons. The survey was conducted face-to-face by stopping people in different places of the Commune of La Florida, between March and June 2018. Convenience sampling has been widely used for market research of different products (18, 26, 37).

Methodological approach and empirical model

In the first instance, descriptive statistics were obtained, including absolute and relative frequency analysis of sociodemographics, purchasing habits, consumption of olive oil, use, and preferences according to the olive oil category. Then a Factor Analysis with maximum likelihood as method of extraction was applied to the statements related to purchasing attributes of olive oil consumers. This is a multivariate analysis technique used to study and interpret the correlations between a group of variables, in which the correlation is due to common factors whose objective is to identify those common factors. At the same time, it seeks to reduce data provided by a correlation matrix making it easier to explain without excessive data loss (48). To validate the former, the dimensionality reduction model required the following conditions: factorial loads (observed component/ variables) over 0.5 (64), constructs made by at least 3 observed variables (31, 32), Cronbach´s Alpha over 0.7 (23), total variance explained over 60% (27) and KMO index over 0.6 (19). Subsequently, those variables obtained by Factor Analysis were analyzed by Cluster Analysis obtaining the market segmentation variable, similarly to that used in Irish wine consumers (22), Tunisian and French olive oil consumers, and Chinese wine consumers (11).

This technique allows analysing a set of variables classifying those of maximum homogeneity within the group and maximum heterogeneity among the groups (48).

RESULTS

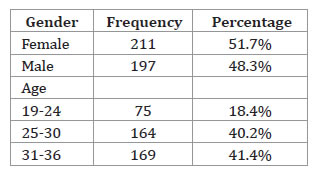

From the total, 51.7% corresponded to females, whereas 48.3% corresponded to males, a similar result to that reported by National Institute of Statistics - INE (30) about the sociodemographic distribution of the Metropolitan Region. Most respondents were between 31 and 36 years old, corresponding to 41.4% followed by those between 25 and 30 years old with 40.2% and then those between 18 and 24 years old with 18.4% (table 1).

Table 1. Age and gender of the respondents.

Tabla 1. Características de género y edad de los encuestados.

Descriptive background of olive oil consumption in Chilean Millenials

From all the respondents, 87.2% declared that they consumed olive oil, whereas 12.8% claimed they did not. This result is similar to that reported by Matsatsinis et al. (2007) for Greek consumers. The difference lies in the frequency of consumption and the consumed quantity, which are higher among the Greeks than the Chileans (36).

From all surveyed consumers of olive oil, 51.1% claimed to do it daily, and 28.2% claimed to do it weekly, which is in accordance with the data obtained in prior studies in Chile (40, 42). Regarding the frequency of olive oil purchase, this is mostly done monthly, with 69.8% (40).

The quantity of olive oil oftenly purchased per occasion by respondents is 500 cubic centimetres (cc) (46.8%). This is similar to that reported by Mora and Magner (2008). Additionally, 13.5% of people buy 1,000 cc formats while 3.2% of person buy-in formats over 1,000 cc. This result is different from that reported by Metta and Guinard (2010) about American consumers with a higher consumption frequency of 1,000 cc (1 Litre) (39).

The category of olive oil most frequently consumed by all the respondents was that of extra virgin olive oil with 71.8%, similar to that reported for Greek consumers (36).

Attributes of olive oil purchasing.

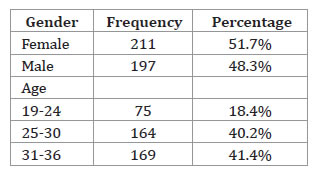

A Factorial Analysis was applied to identify the attributes in olive oil purchasing. Initially, the analysis considers 12 observed variables as attributes related to the purchasing process, but only 8 observed variables are maintained. The discarded attributes corresponded to the "trademark", the "system of organic production", "olive variety", and "price". All of them presented correlations with the factor under 0.3. Price, was isolated only by one factor, and consequently excluded from the factor model. The KMO index was 0.76, which is considered acceptable (19). Table 2 shows how the attributes considered when purchasing olive oil can be explained by two groups or "factors" of attributes.

Table 2. Oil olive: Attributes/Dimensions related to purchase decision process.

Tabla 2. Aceite de oliva: atributos / dimensiones relacionadas con el proceso de decisión de compra.

The former - called "Extrinsic Attributes" factor included "information at the point of sale", "electronic advertising and offers", "internet sales", and "product origin", being those related to "electronic commerce", the ones that showed negative correlations with the component.

These attributes related to electronic commerce have been considered an important factor by olive growing companies, since the image of the product on the internet is considered essential to boost sales (38). This factor, with 29.9% of variance, was explained by 4 observed variables, with a Conbrach's Alpha of 0.73. The other factor, called "Intrinsic Attributes" included "olive oil category", "acidity", "flavour", and "colour". This factor, representing 27.7% of the variance was explained by 4 observed variables and had a Conbrach's Alpha of 0,74, considered acceptable by literature (2, 23, 43).

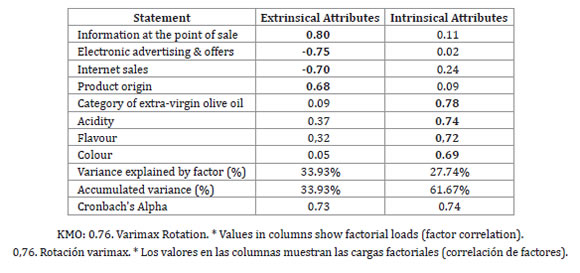

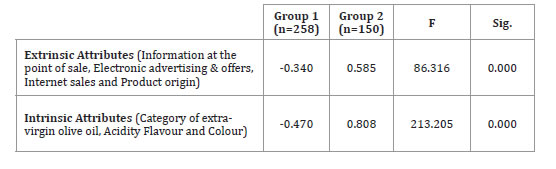

Considering the results of Factor Analysis in table 2, a hierarchical Cluster Analysis was applied to obtain two consumer segments (table 3, page 239).

Table 3. Segment characterization based on factors influencing olive oil purchase.

Tabla 3. Caracterización de segmentos basada en factores que influyen en la compra de aceite de oliva.

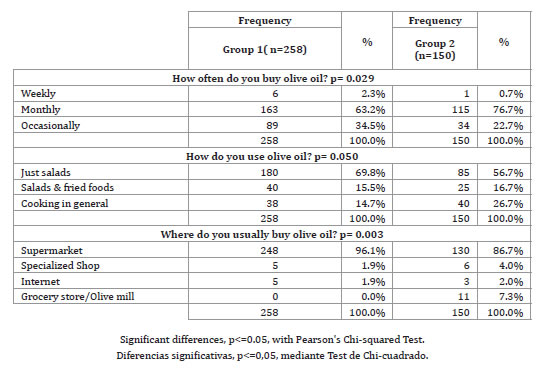

Group 1: "Non- Traditional or Millennials Consumers" (n=258). This result is the biggest of both groups, mainly formed by people between 30 and 35 years old. This segment was characterized by having a negative attitude towards the olive oil origin.

This is similar to that reported for French and Tunisian consumers, where one of the three segments detected showed an unfavourable tendency upon the origin attribute (11). Additionally, it showed negative attitudes upon information at the point of sale and upon intrinsic attributes, such as acidity and flavour, which could be associated with ignorance of the product. On the contrary, it showed positive attitudes upon those attributes related to electronic commerce. It is important to mention that a significant number of consumers in this segment have a daily consumption frequency, mainly used to dress salads and usually purchased monthly at supermarkets (over 96% of the segment) (table 4, page 240).

Table 4. Segment characterization based descriptive aspects of olive oil consumption.

Tabla 4. Caracterización de segmentos basados en aspectos descriptivos de consumo de aceite de oliva.

Group 2: "Traditional Consumers" (N=150). This group was mainly formed by people between 24 and 35 years old, representing 36.7% of the sample, declaring that they consumed olive oil. The main characteristic of this segment was their favourable attitude to consider intrinsic attributes in their purchase, such as category, acidity, flavour and colour. Along with a positive attitude towards advertising at points of sale, which is in line with that reported by Adasme et al. in 2013 concerning vegetable consumption (1). Just as the previous group, this segment mainly showed daily consumption and monthly purchases at supermarkets (table 4, page 240).

There were no significant differences in any segment in relation to daily consumption and considering olive oil as an expensive product. More than 90% of surveyed consumers considered olive oil to be expensive and declared to have a daily consumption.

DISCUSSION

What do "Millennials" consumers of oil olive consider when purchasing in the Metropolitan Region, Chile? That was the central question of this survey. The smallest group of olive oil consumers (n=150) declared to consider oil category in the purchase. This preference is in line with that reported by Mtimet et al. (2013), who determined that the Tunisian consumers' favourite type of oil is extra virgin followed by virgin olive oil (46). Bernabéu et al. (2009) obtained similar results in Spanish consumers.

About the preferred purchase format of the consumers of this survey, our results agree on those found by Santosa and Guinard (2011), who determined that consumers of extra virgin olive oil from the State of California, USA, preferred purchase formats of 750 cc and 500 cc (58). According to the authors, this result could be related to the fact that extra virgin olive oil market in the USA is an emerging market, which is relatively similar to the case of the Chilean market. Additionally, In Chile olive oil is considered as a valuable good because there is a direct relationship between consumers' income and quantities of olive oil demanded (54). The most usual purchase place is the supermarket, which is like that reported for Greek consumers (34).

Regarding the Cluster Analysis, two groups of consumers were found. Group 1 called "Non- Traditional or Millennials Consumers", included the most significant number of consumers with 258 respondents. Group 2 called "Traditional Consumers", included 150 people. The main differences between both groups were centered upon those attributes considering intrinsic characteristics, such as acidity, colour and flavour, and those extrinsic ones, such as online advertising and offers and internet sales.

When purchasing olive oil, Group 1 considered attributes associated with electronic commerce instead of intrinsic ones. About flavour, literature points out a new generation of extra virgin olive oil consumers that seem to prefer a product with a quite simple and neutral flavour, thus generating an important market division (12, 13, 16, 45, 46, 57). For this group of consumers, since they value the intrinsic attributes of olive oil, the attitude towards the product could be improved if information about it was provided, as suggested by Salazar-Ordonez et al. (2018), for Spanish consumers.

Group 2 evaluated intrinsic attributes at the moment of purchasing, especially those of flavour and colour, which is similar to that reported by Del Giudice et al. (2012). These attributes had been used in the past (16), possibly influenced by the previous generation. This group also considered product origin and information provided at the point of sale. Besides, consumers from Group 1 did not appreciate attributes like origin and information at the point of sale, which could be associated to inadequate knowledge or appreciation of the product. In relation to similarities, both groups considered olive oil to be expensive. In this context, the research made by Dekhili and d'Hauteville (2009) reported that price is the most critical free -choice attribute when choosing olive oil in Tunisianand France (10). Moreover, Delgado and Guinard (2011) determined that price, available information, and the prestige of AOEV (Extra-Virgin Origin Appeal) were crucial factors encouraging purchases of the American survey respondents (12).

Regarding origin, both the studies in Spanish consumers (4), and in northern California consumers of extra-virgin olive oil (58), determined that origin was an important attribute, preferring those olive oils of national origin in Spain as much as in the USA. This result agrees on that found in Segment 2, although this attribute is not considered in Segment 1. Origin of olive oil is positively considered by the consumers of Segment 2 and could work as a driving force to choose this product (11, 60).

Trademark is an important attribute when purchasing olive oil in traditionally producing countries, such as Italy (14, 15) and Spain (20, 23). However, the results obtained in Chilean consumers concerning trademark was not associated with purchasing. This situation is related to the relatively recent development of the olive oil market in Chile.

Finally, it would be interesting to include, in a future research other attributes, such as "packaging design". This attribute should be addressed for millennial consumers, since it is considered as an important factor in non-technological innovation in the Agri-food industry (24).

CONCLUSIONS

The results obtained suggest that the decision to purchase olive oil in the surveyed consumers can be explained by intrinsic ("category of oil", "flavour", and "colour") and extrinsic attributes ("information at the point of sale", "electronic advertising & offers", "internet sales", and "product origin").

The results allow establishing two groups or segments of the consumer in Generation Y. There is a group of consumers of a traditional profile, with a similar behaviour to generation X or older ones. This group considers attributes, such as colour, flavour, acidity, oil category, information at the point of sale, and oil origin at the moment of purchase. The other group is a more typical Millennials with a high appreciation of online communication and a rejection of attributes considered by more traditional consumers.

The results indicate the need to develop specific marketing strategies for this generation, emphasizing the creation of product knowledge, related to information on the characteristics of the olive varieties used in oil production, olive oil tastings, and, above all, distribution and communication channels linked to social networks and the Internet. Emphasis should be made in tuning with the requirements of each market segment.

1. Adasme-Berríos, C.; Jara-Rojas, R.; Ramos-Cabello, B.; Rodríguez, M.; Mora, M. 2013. Consumer responses to agricultural produce advertising in the O'Higgins Region of Chile. Cienc. Inv. Agr. 40 (1). Available in: http://dx.doi.org/10.4067/S0718-16202013000100003

2. Adasme-Berríos, C.; Sánchez, M.; Mora, M.; Díaz, J.; Schnettler, B.; Lobos, G. 2019. Effects of food-related health concerns and risk perception on the consumption frequency of fresh vegetables. Revista de la Facultad de Ciencias Agrarias. Universidad Nacional de Cuyo. Mendoza. Argentina. 51(2): 289-30.

3. Ardeshiri, A.; Rose, J. 2018. How Australian consumers value intrinsic and extrinsic attributes of beef products. Food Quality and Preference. 65: 146-163.

4. Bernabéu, R.; Olmeda, M.; Díaz, M.; Olivas, R. 2009. Oportunidades comerciales para el aceite de oliva de Castilla-La Mancha. [en línea]. Universidad de Castilla La Mancha. p. 10.

5. Cardona, J.; Paredes, M. 2014. Segmentación de mercados. Revista Académica Facultad de Ciencias Económicas y Empresariales. N° 10.

6. Cavallo, C.; Piqueras-Fiszman, B. 2017. Visual elements of packaging shaping healthiness evaluations of consumers: The case of olive oil. J Sens Stud. 32: e12246. Available in: https://doi.org/10.1111/joss.12246

7. Cheng, J. M. S.; Wang, E.; Lin, J. Y. C.; Chen, L. S.; Huang, W. H. 2008. Do extrinsic cues affect purchase risk at international e-tailers: The mediating effect of perceived e-tailer service quality. Journal of Retailing and Consumer Services. 15: 420-428.

8. CHILEOLIVA. 2016. Informe anual mercado nacional de aceite de oliva. Available in: https:// www.chileoliva.cl/wp-content/uploads/2017/04/BOLMERC1SEM2016.pdf. (Date of consultation: 17/10/17).

9. Dawn, V.; Thomas, P. 2013. Generation y value and lifestyle segments. USA. Journal of Consumer Marketing, 30: 7.

10. Dekhili, S.; d'Hauteville, F. 2009. Effect of the region of origin on the perceived quality of olive oil: An experimental approach using a control group. Food Quality and Preference. 20: 525-532.

11. Dekhili, S.; Sirieix, L.; Cohen, E. 2011. How consumers choose olive oil: The importance of origin cues. Food Quality and Preference. 22: 757-762.

12. Delgado, C.; Guinard, J. X. 2011. How do consumer hedonic ratings for extra virgin olive oil relate to quality ratings by experts and descriptive analysis ratings? Food Qual Preference. 22(2): 213-225.

13. Delgado, C.; Guinard, J. X. 2012. Internal and external quality mapping as a new approach to the evaluation of sensory quality-a case study with olive oil. J Sens Stud. 27(5): 332-343.

14. Del Giudice, T.; D'Elia, A. 2001. Valorizzazione dell’ olio extravergine di oliva meridionale: Una proposta metodologica per l’analisi delle preferenze. Rivista di Economia Agraria. 56(4): 11-42.

15. Del Giudice, T; Panico, T.; Caracciolo, F.; Cicia, G. 2012. Le preferenze dei consumatori italiani nei confronti dell'attributo biologico nell’ olio extra-vergine di oliva alla luce della nuova normativa sull'etichettatura. Available in: V Workshop Nazionale GRAB-IT. Ancona, (Date of consultation: 11/05/2012).

16. Del Giudice, T.; Cavallo, C.; Caracciolo, F.; Cicia, G. 2015. What attributes of extra virgin olive oil are really important for consumers: a metaanalysis of consumers' stated preferences. Agricultural and Food Economics. 3:20 DOI 10.1186/s40100-015-0034-5.

17. Detre, J. D.; Mark, T. B.; Clark, B. M. 2010. Understanding Why College-Educated Millennials Shop at Farmers Markets: An Analysis of Students at Louisiana State University. Journal of Food Distribution Research. 41(3): 14-24.

18. Duarte, A. 2015. Wine as a unique and valuable resource. British Food Journal. 117(11): 2757-2776.

19. Field, A. 2009. Discovering Statistics Using SPSS. Sage Publications.

20. Garrido, C. 2015. Análisis del comportamiento del consumidor de aceites de oliva en países emergentes: Brasil y Chile. [on line]. Master Olivar, Aceite de oliva y Salud. Andalucía. España: Universidad de Jaén.

21. Gázquez-Abad, J. C.; Sánchez-Pérez, M. 2009. Factors influencing olive oil brand choice in Spain: an empirical analysis using scanner data. Agribusiness. 25(1): 36-55.

22. Geraghty, S.; Torres, A. 2009. The Irish wine market: a market segmentation study", International Journal of Wine Business Research. 21(2): 143-154.

23. González, J.; Pazmiño, M. 2015. Cálculo e interpretación del Alfa de Cronbach para el caso de validación de la consistencia interna de un cuestionario, con dos posibles escalas tipo Likert. Revista Publicando, 2 (1). 2015, 62-77. Available from: https:// www.researchgate.net/publication/272682754_Calculo_e_interpretacion_del_ Alfa_de_Cronbach_para_el_caso_de_validacion_de_la_consistencia_interna_de_un_ cuestionario_con_dos_posibles_escalas_tipo_Likert [accessed Sep 18 2019].

24. González-Yebra, O.; Aguilar, M. A.; Aguilar, F. J. 2019. A first approach to the design component in the agri-food industry of southern Spain. Revista de la Facultad de Ciencias Agrarias. Universidad Nacional de Cuyo. Mendoza. Argentina. 51(1): 125-146.

25. Grunert, K.; Loose, S.; Zhou, Y.; Tinggaard, S. 2015. Extrinsic and intrinsic quality cues in Chinese consumers purchase of pork ribs. Food Quality and Preference. 42: 37-4726.

26. Güney, O.; Sangün, L. 2017. Seafood consumption attributes and buying behaviours according to the generations: a study on millennial generation in Turkish market. Turkish Journal of Agriculture. Food Science and Technology. 5(12): 1604-1608.

27. Hair, J.; Black, W.; Babin, B.; Anderson, R. 2014. Multivariate data analysis. Ed. Pearson.

28. Henchion, M.; McCarthy, M.; Resconi, V. 2017. Beef quality attributes: A systematic review of consumer perspectives. Meat Science. 128: 1-7.

29. Hu, F. 2003. The Mediterranean diet and modality: Olive oil and beyond. Waltham. MA. ETATSUNIS. Massachusetts Medical Society.

30. INE (Instituto Nacional de Estadística). 2002. Santiago. Chile. Available in:http:// reportescomunales.bcn.cl/2012/index.php/La_Florida#Poblaci.C3.B3n_ total_2002_y_proyectada_2012_INE (Date of consultation: 27/07/2015).

31. Jackson, D. L.; Gillaspy, J. A. (Jr.); Purc-Stephenson, R. 2009. Reporting practices in confirmatory factor analysis: An overview and some recommendations. Psychological Methods. 14(1): 6-23. Available in: http://dx.doi.org/10.1037/a0014694

32. Kline, R. 2011. Principles and practices of structural equation model. New York: The Guilford Press.

33. Kotler, P.; Kartajaya, H.; Seteiawan, I. 2010. Marketing 3.0. Cómo atraer a los clientes con un marketing basado en valores. México: LID Editorial.

34. Krystallis, A.; Ness, M. 2005. Consumer preferences for quality foods from a south European perspective: A conjoint analysis implementation on Greek olive Oil. International Food & Agribusiness Management Review. 8(2): 62-91.

35. Lee, P.; Lusk, K.; Mirosa, M.; Oey, I. 2015. An attribute prioritisation-based segmentation of the Chinese consumer market for fruit juice. Food Quality and Preference. 46: 1-8.

36. Matsatsinis, N.; Grigoroudis E.; Samaras, A. 2007. Comparing distributors' judgments to buyers' preferences. A consumer value analysis in the Greek olive oil market. Chania. Greece. Technical University of Crete. p. 21.

37. McCarthy, B.; Liu, H. B.; Chen, T. 2014. Trends in organic food consumption in China: opportunities and challenges for regional Australian exporters. In: Proceedings of the Sustainable Economic Growth for Regional Australia. From: SEGRA 2014: Sustainable Economic Growth for Regional Australia Conference. 8-10. Alice Springs. NT. Australia.

38. Medina Viruel , M. J.; Bernal Jurado, E.; Mozas Moral, A.; Fernández Uclés, D. 2018. Empresas agroalimentarias y adopción de las TIC: el caso del sector del aceite de oliva ecológico en España. Revista de la Facultad de Ciencias Agrarias. Universidad Nacional de Cuyo. Mendoza. Argentina. 50(2): 233-251.

39. Metta, S.; Guinard, J. 2010. Means-end chains analysis of extra virgin olive oil purchase and consumption behavior. Food Quality and Preference. 22: 304-316.

40. Mora, M.; Magner, N. 2008. El mercado del aceite de oliva en la región Metropolitana: segmentación de mercados, un análisis cuantitativo. Facultad de Ciencias Agronómicas. Universidad de Chile. Revista Antumapu. 7(1/2): 46-49.

41. Mora, M.; Espinosa, J.; Schenettler, B.; Echeverria, G. 2011. Perceived quality in fresh peaches: an approach through structural equation modelling. Ciencia e Investigación Agraria. 38(2): 179-90.

42. Mora, M.; Schnettler, B.; Fichet, T.; Silva, C.; Estrada, L. 2013. Desarrollo estratégico del mercado del aceite de oliva en Chile. 9: 227-262. In: Aportes al cultivo del olivo, Universidad de Chile. Facultad de Ciencias Agronómicas. Santiago, Chile.

43. Morales, P. 2013. El Análisis Factorial en la construcción e interpretación de tests, escalas y cuestionarios. Madrid. Facultad de Ciencias Humanas y Sociales. Universidad Pontificia Comillas. p. 45.

44. Moreno, E.; Lezcano, S. 2015. Aceite de oliva: Piedra angular de la dieta Mediterránea. OLIVAE Revista Oficial del Consejo Oleícola Internacional. 121: 19-27.

45. Mtimet, N.; Ujiie, K.; Kashiwagi, K.; Zaibet, L.; Nagaki, M. 2011. The effects of information and country of origin on Japanese olive oil consumer selection. International Congress. August 30-September 2. European Association of Agricultural Economists. Zurich. Switzerland.

46. Mtimet, N.; Zaibet, L.; Zairi, C.; Hzami, H. 2013. Marketing olive oil products in the Tunisian local market: the importance of quality attributes and consumers' behavior. J Int Food Agribusiness Mark. 25(2): 134-145.

47. Mueller, S.; Hervé, R.; Yann, C. 2011. How strong and generalizable is the Generation Y effect? A cross-cultural study for wine. A cross-cultural study for wine. International Journal of Wine Business Research. 23(2): 125-144.

48. OLIVAE Revista Oficial del Consejo Oleícola Internacional. 2015. Available in: http://www. internationaloliveoil.org/estaticos/view/131-world-olive-oil-figures?lang=es_ES (Date of consultation: 27/07/2016).

49. Olson, J.; Jacoby, J. 1972. Cue utilization in the quality perception process. In: Proceedings of the Third Annual Conference of the Association for Consumer Research. Ed. M. Venkatesan. Association for Consumer Research. Chicago. 167-179.

50. Owen, R. W.; Giacosa, A.; Hull, W. E.; Haubner, R.; W€urtele, G.; Spiegelhalder, B.; Bartsch, H. 2000. Olive-oil consumption and health: the possible role of antioxidants. Lancet Oncology. 1: 107-112.

51. Pincheira, A.; Arenas, T. 2016. Caracterización de los profesionales de la "Generación Millennials" de Arica y Parinacota, Chile, desde una mirada del capital intelectual. Interciencia. vol. 41(12): 812-818.

52. Pladeco. 2009. Informe 2009-2016. Chile. Municipalidad de la Florida. Available in:http://www.laflorida. cl/web/wp-content/uploads/2010/12/37b-METODOLOGIAPLADECO-2009-2016.pdf (Date of consultation: 20/04/2017).

53. Reeves, T. C.; Oh, E. 2008. Generational differences handbook of research on educational communications and technology. Chapter: 25. Publisher: Taylor & Francis Group.

54. Romo, R.; Labrín, C.; Lizama, V.; Herrera, R. 2014. Caracterización de los consumidores chilenos de aceite de oliva: un análisis exploratorio aplicado a la Región del Biobío. Economía Agraria. 18: 47 -61.

55. Romo, R.; Lagos, M.; Gil, J. M. 2015. Market values for olive oil attributes in Chile: a hedonic price function. British Food Journal. 117(1): 358-370. https://doi.org/10.1108/BFJ- 01-2014-0009

56. Salazar-Ordóñez, M.; Rodríguez-Entrena, M.; Cabrera, E.; Henseler, J. 2018. Understanding product differentiation failures: The role of product knowledge and brand credence in olive oil markets. Food Quality and Preference. 68(2018): 146-155.

57. Santosa, M.; Abdi, H.; Guinard, J. X. 2010. A modified sorting task to investigate consumer perceptions of extra virgin olive oils. Food Qual Preference 21(7): 881-892.

58. Santosa, M.; Guinard, J. X. 2011. Means-end chains analysis of extra virgin olive oil purchase and consumption behavior. Food Quality and Preference. 22: 304-316.

59. Santosa, M.; Clow, E. J.; Sturzenberger, N. D.; Guinard, J. X. 2013. Knowledge, beliefs, habits and attitudes of California consumers regarding extra virgin olive oil. Food Research International. 54: 2104-2111.

60. Scarpa, R.; Philippidis, G.; Spalatro, F. 2005. Product-country images and preference heterogeneity for Mediterranean food products: A discrete choice framework. Agribusiness. 21: 329-349.

61. Schawbel, D. 2015. 10 New Findings About The Millennial Consumer. Forbes 20 June. Available in: https://www.forbes.com/sites/danschawbel/2015/01/20/10-new-findingsabout- the-millennial-consumer/#6776a1296c8f

62. Taylor, S.; Cosenza, R. 2002. Profiling later aged female teens: mall shopping behavior and clothing choice. Journal of Consumer Marketing. 19(5): 393-408.

63. Taylor, P; Keeter, S. 2010. "Millennials a portrait of generation next: confident, connected, open to change. Washington. DC: The Pew Research Center.

64. Vale-Nieves, O.; Rivera-Maldonado, M. 2015. Creación y validación del cuestionario sobre uso de mensajes de texto en el aula. Revista Puertorriqueña de Psicología. 26(1): 40-54.

65. Verbeke, W.; Van Wezemael, L.; de Barcellos, M.; Kügler, J.; Hocquette, J.; Ueland, Ø.; Grunert, K. 2010. European beef consumers’ interest in a beef eating-quality guarantee: insights from a qualitative study in four EU countries. Appetite. 54: 289-296.

66. Zeithaml, V. A. 1988. Consumers perceptions of price, quality and value: A means-end model and synthesis of evidence. Journal of Marketing.